How To Search Hawaii Business Entities

- How To Search Hawaii Business Entities

- How To Find the Owner of a Business Entity in Hawaii?

- Why Conduct a Hawaii Entity Search?

- Who Holds Data for Hawaii Business Entity Search?

- What Entities Can You Register in Hawaii?

- How Do I Check If a Business Entity Name is Taken in Hawaii?

- How Do I Set Up a Business Entity in Hawaii?

- How Much Does It Cost To Start a Business In Hawaii?

- Additional Information Available on the Hawaii Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Hawaii

Approximately 5,000 new businesses are formed annually in Hawaii, with variations following economic conditions and industry trends. Hawaii has seen consistent modest growth in business formations with business formations largely clustering around tourism, local enterprises, and small business developments.

According to the United States Small Business Administration Office of Advocacy, there were 141,460 small businesses in Hawaii in 2022, making up 99.3% of the state's businesses. Between March 2020 and March 2021, 4,978 establishments were opened in the Aloha State, with small businesses accounting for 4,584 of these openings.

Businesses are registered with the Business Registration Division of the Hawaii Department of Commerce and Consumer Affairs. Individuals looking to find information on entities and establishments in the state may contact the DCCA for information.

Choose Your Search Criteria

From the HBE page, you can only search by providing the name of the business. You may provide a partial or complete name of the business. However, the search tool on the page has a “search mode” feature, allowing users to toggle between “contains” and “begins with.”

Review Search Results

After providing part of the business name or the complete business name, click the search button to get a list of Hawaii-registered entities with that name. In addition to the names, you may access their status (expired, active, or merged), file number, and record type.

Further Assistance

If you need further assistance searching for business entities in Hawaii, contact the Business Registration Division of the Hawaii Department of Commerce and Consumer Affairs. The division is located at:

King Kalakaua Building

335 Merchant Street, Rm. 201

Honolulu, Hawaii 96813

Email: breg@dcca.hawaii.gov

Phone: (808) 586-2727

Alternatively, you may send an email to the division at breg@dcca.hawaii.gov or call (808) 586-2727

How To Find the Owner of a Business Entity in Hawaii?

Business owners’ names are not directly listed in the search results available from the business entity database provided by the Hawaii Business Registration Division. However, the result typically lists an agent’s name, which in some cases, is the name of the business’ owner. Also, owner names may be available from the documents available in the “Buy Available Docs” tab in the business search result.

Other ways through which you may find the owner of a business entity include:

- The Business' Website

You may be able to find the owner of a website by checking the “leadership”, “about us”, or another similar page on the website of the business. Many businesses provide information on their leadership, including their owner’s name on their website.

- Chamber of Commerce

The Chamber of Commerce in Hawaii maintains a directory of local businesses and allows users to find businesses located in different Hawaii locations. The directory may list contact details, business owners' names, or primary representatives.

Why Conduct a Hawaii Entity Search?

You may perform a Hawaii entity search for the following reasons:

A Hawaii business search allows anyone to confirm whether a business is registered and operating legally in Hawaii. This step is important for consumers, investors, or potential partners looking to conduct due diligence and avoid fraudulent or unregistered entities.

A Hawaii entity search may help you gain insights into a company’s formation date, previous filings, or amendments to its structure. This may be useful for investors and partners in mergers, acquisitions, or partnership scenarios.

By performing a Hawaii entity search, companies can verify whether a supplier or partner is officially registered, active, and in good standing with the state. This ensures that the entity meets legal and regulatory standards, reducing the risk of fraud or unreliable partnerships.

Performing a business entity search allows you to determine whether a business is in good standing with the Hawaii Department of Commerce and Consumer Affairs (DCCA). Non-compliance or lapsed registration can signal operational or financial issues which may help you choose to avoid doing business with an inactive or fraudulent business.

Who Holds Data for Hawaii Business Entity Search?

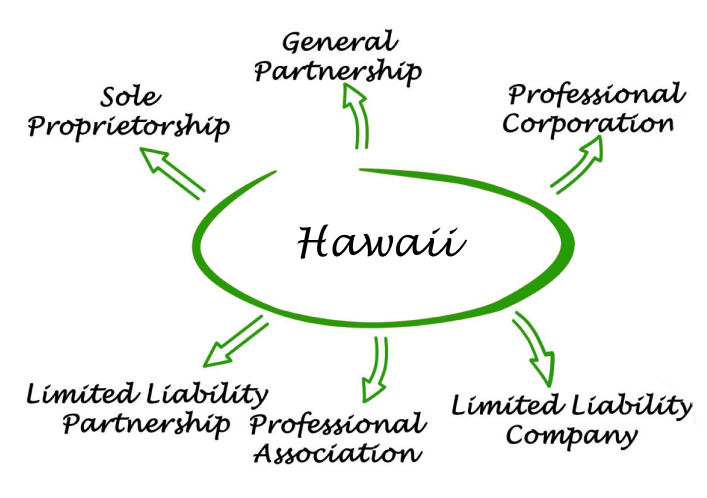

What Entities Can You Register in Hawaii?

Hawaii allows people looking to establish businesses to choose from a wide range of business structures. However, the state recommends that individuals seek advice from qualified attorneys or accountants before making a choice. The following are the common business structure types in Hawaii:

A sole proprietorship is the simplest and most common business structure in Hawaii. Owned by a single individual, the owner is personally liable for all debts and obligations.

A general partnership involves two or more individuals sharing ownership, profits, and liabilities equally unless otherwise agreed upon. Registration with the Hawaii DCCA is required to operate under a trade name. Partners are personally liable for the business's debts and obligations.

An LP consists of general partners who manage the business and are personally liable, and limited partners whose liability is limited to their investment. LPs must register with the Hawaii DCCA and are often used for investment ventures.

An LLP provides liability protection to its partners for debts and obligations incurred by the business. It is commonly used by professional groups like lawyers or accountants.

An LLLP is a hybrid of LP and LLP, providing liability protection to both general and limited partners. It is less common but useful for partnerships seeking to limit liability while retaining an LP structure. Registration with the Hawaii DCCA is required.

A corporation is a separate legal entity that provides limited liability to its shareholders. It requires filing Articles of Incorporation with the Hawaii DCCA. Profits are taxed at both corporate and personal levels, and it is ideal for large-scale operations.

An S Corporation allows profits and losses to pass through to shareholders' personal tax returns, avoiding corporate taxes. Hawaii corporations must file Articles of Incorporation and elect S Corporation status with the IRS. It is suitable for small to medium-sized businesses.

A popular choice for small businesses, LLC combines the liability protection of a corporation with the tax benefits and operational flexibility of a partnership. Single-member and multi-member LLCs must file Articles of Organization with the Hawaii DCCA and adopt an operating agreement.

A DBA name in Hawaii is an alternate name for a business. It stands for "doing business as” and is a name that a business may operate under that is not its legal name. The DBA name is available to corporations, sole proprietorships, general partnerships, limited liability companies, and nonprofit business structures. In Hawaii, DBAs may be referred to as trade names.

How Do I Check If a Business Entity Name is Taken in Hawaii?

Although you may use the HBE search tool to find out if a business has registered the business name you are considering for use, the Business Registration Division of the DCCA states that the results of the HBE search tool may not be used as a definitive method to determine business name availability.

How Do I Set up a Business Entity in Hawaii?

After assembling your team to include necessary professionals (such as attorneys, insurance agents, vendors, consultants, accountants, bankers), you may take the following steps to set up a business entity in Hawaii:

- Register with the Business Registration Division of the DCCA: You and your team must decide which business structure suits your entity. After, visit the HBE portal on the DCCA website to complete the application process.

- Obtain a Federal Employer Identifier Number (FEIN): You may apply for a FEIN via the IRS website or call the agency toll-free at (800) 829-1040.

- Obtain General Excise Tax License: Form BB-1 used for getting a general excise tax license is available at the Hawaii Department of Taxation website. You may also complete the application online via the HBE portal.

- Obtain licenses and permits: In Hawaii, businesses must obtain a general business license (or business tax certificate), issued by individual cities or municipalities. Each city has unique requirements, and businesses operating in multiple locations must apply separately in each city. Additional permits may be required at the county or state level. Check with local city offices to identify specific licensing needs.

- Open a Business Banking Account: Once you have obtained a FEIN and completed the tax essentials, you may proceed to open a business bank account in Hawaii. LLCs, LLPs, and corporations must have a business bank account, while unincorporated partnerships and sole proprietors are not obligated to open separate business accounts from their personal accounts. To open a business account, visit a local bank to complete the requisite paperwork.

How Much Does It Cost to Start a Business in Hawaii?

The cost of starting a business in Hawaii varies depending on factors such as business structure, required licenses and permits, and additional services that the business may render. When looking to start a business in Hawaii, you may expect to incur the following expenses:

Additional Information Available on the Hawaii Department of Commerce and Consumer Affairs Website

FAQs About Business Entity Searches in Hawaii

Here are some of the most frequently asked questions and answers regarding business entity searches in Hawaii.

- Why would I need to search for a business entity in Hawaii?

Conducting a business entity search in Hawaii is essential for verifying the legitimacy and compliance of a business. This process allows you to confirm whether a business is registered with the State of Hawaii and check its standing with the Department of Commerce and Consumer Affairs (DCCA).

- What types of entities can I search for in Hawaii?

Using the HBE business search tool, you may search for a corporation, domestic corporation, foreign corporation, professional corporation, domestic nonprofit corporation, foreign nonprofit corporation, cooperative, corporation sole, sustainable business corporation, domestic limited liability company, foreign limited liability company, domestic limited liability partnership, foreign limited liability partnership, limited partnership, domestic limited partnership, foreign limited partnership, domestic general partnership, and foreign general partnership.

- Where can I perform a business entity search in Hawaii?

You may perform a business entity search in Hawaii using the business search tool on the Hawaii Business Express page of the DCCA website.

- What information do I need to conduct an entity search in Hawaii?

You need to know at least part of the name of the entity or the entity’s registered agent to conduct an entity search via the DCCA business search tool.

- How do I find the official name of a Hawaii business?

You may find the official name of a Hawaii business using the business search tool on the Hawaii Business Express page of the DCCA website. By providing the trade name or the business registered agent’s name, you may find the official name of a Hawaii business.

- Can I search for foreign entities in Hawaii?

Yes. The business search tool on the DCCA website allows users to search for domestic and foreign entities in the State.

- What information can I find in the Hawaii entity search?

You may find an entity's service mark, file number, certificate number, status, purpose, category, mailing address, registrant, registration date, and expiration date in the entity search.

- How do I verify if a Hawaii business is in good standing?

The Hawaii business search tool provides information on the registration date, status, and expiry date of a business registration. Using this information, you can determine if a business is in good standing with the State of Hawaii.

- Can I search for an entity in Hawaii by its owner’s name?

The business search tool on the DCCA website does not allow users to find an entity by its owner’s name. However, if the registered agent doubles as the owner of the business, you may use the registered agent search option to find the associated business.

- How often is the Hawaii business entity database updated?

The registered business or entity database of the Hawaii Department of Commerce and Consumer Affairs is updated regularly as new businesses register or update their information with the DCCA.

- Can I obtain copies of business filings in Hawaii?

Yes, you can obtain copies of business filings in Hawaii by contacting the DCCA’s Business Registration Division (BREG).

- How do I find out who the registered agent of a Hawaii business is?

You may find the registered agent of a Hawaii business by providing the name of the business in the state’s business search tool. The information provided on the results page will include details about the registered agent.

- How can I search for Hawaii businesses by their tax ID number?

The Hawaii DCCA does not provide an option in its business search tool for users to find Hawaii businesses by their tax ID numbers.

- What should I do if I can’t find a business entity in the Hawaii search?

If you cannot find a business entity in the Hawaii search, consider contacting the DCCA for assistance by calling (808) 586-2727. Alternatively, consider consulting with an attorney or professional investigator in finding the entity.

- How To Search Hawaii Business Entities

- How To Find the Owner of a Business Entity in Hawaii?

- Why Conduct a Hawaii Entity Search?

- Who Holds Data for Hawaii Business Entity Search?

- What Entities Can You Register in Hawaii?

- How Do I Check If a Business Entity Name is Taken in Hawaii?

- How Do I Set Up a Business Entity in Hawaii?

- How Much Does It Cost To Start a Business In Hawaii?

- Additional Information Available on the Hawaii Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Hawaii